Know when to fold ’em

Know when to walk away

Know when to run

You never count your money

When you’re sittin’ at the table

There’ll be time enough for countin’

When the dealin’s done

A perennial question in mergers and acquisitions is when to sell your company. The ideal is to sell at the top of the market. However, a decision to sell is influenced by personal issues and motivations, such as age, health and succession plans, or lack thereof, by the evolutionary stage of the enterprise and by external factors such as market conditions, prospects and trends.

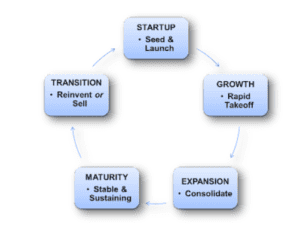

A useful tool for thinking about the selling decision is the Business Life-Cycle Model. The customary stages of a firm’s life-cycle are Start-Up, Growth, Expansion, Maturity and Transition. In Startup, the firm begins, then undergoes a rapid growth phase, expands through consolidation, reaches stability and plateaus to a maturity phase and then enters a transition stage which is either a reinvention or an exit. One company’s exit is another company’s startup, growth or expansion. A sale can actually occur at any stage. One way of depicting the business life-cycle is the circular model below, suggesting a systems perspective of business and business assets.

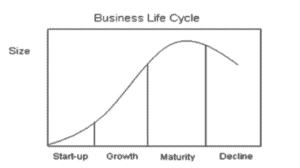

However, because this graphic is more of a “systems”, macroeconomic model of a firm’s life-cycles, it fails to depict what can happen to an individual firm at the maturity stage, when a plateau is reached. See below how the business life-cycle looks now:

Once this critical maturity stage is reached owners, needs to consider sale as a distinct and live option before it is too late. Thus, if a company is not going to commit to a reinvention cycle, then the possibility of a sale needs to be considered in order to receive full market value.

So what is an owner to do? The following are suggestions:

- Know what stage of the business life cycle your company is in.

- Maintain a relationship with a Mergers and Acquisitions Advisor who is acutely aware of what happening in your industry,has a good sense of the future, has excellent contacts and credibility with the companies in an expansion/acquisition phase and is experienced and capable in closing deals.

- Understand your personal issues that may prompt the decision to sell such as desire to retirement, “burned-out,” health, age and lack of succession.

- Comprehend that the ideal sale decision starts with the recognition of your company’s stage in the business cycle, the role of personal issues such as age and succession and market conditions.

The ideal sale moment occurs when 1, 2 and 3 immediately above optimally CONVERGE so that maximum value is realized.

Once a business reaches the maturity stage, the decision to reinvent or sell is up to you. But owners needs to be mindful of market conditions and the uncertainty of the future. You need to know when to leave the table and take your chips. Follow the words of the great American philosopher William James, warning us that, “Woe to him whose beliefs play fast and loose with the order which realities follow in his experience: they will lead him nowhere or else make false connections.”